BlogBookkeeping tips to help you build a solid financial foundation for your business. |

|

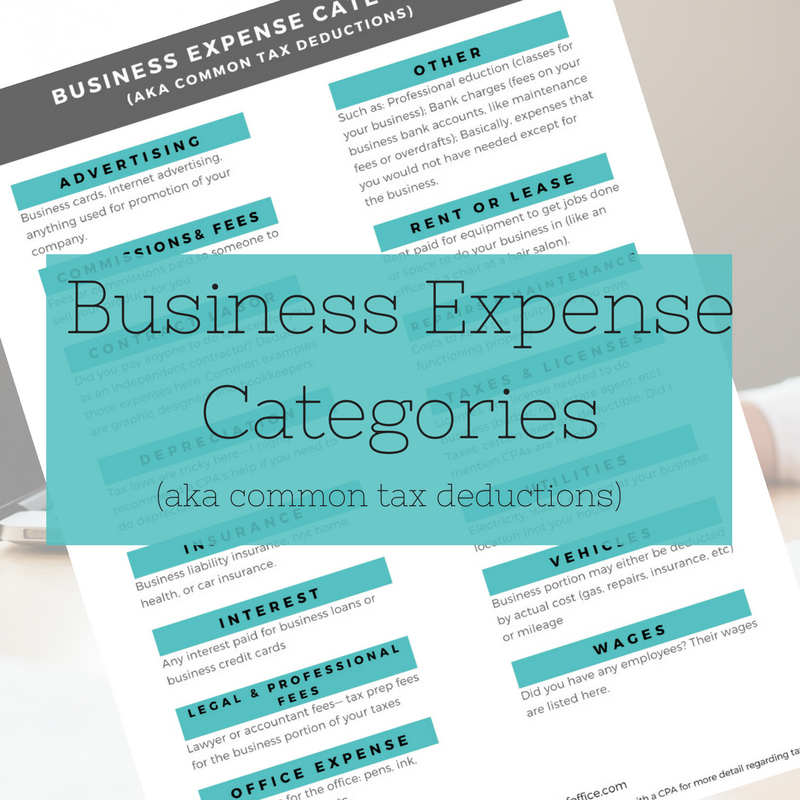

Tracking business expenses is important because they ultimately become tax deductions which means saving money (and who doesn't want to save money!). But where's an entrepreneur to start? Here is a quick overview to get you on the right track.

Advertising. Includes any materials you use for marketing (e.g. bridal guide magazines, Facebook ads, and email services like Flodesk or Mail Chimp. Unbranded gifts, such as books, are not considered advertising (they are considered "other expenses" though!). Contract Labor. Payments you make to independent contractors (e.g. freelancers you hired for additional project support: virtual assistant, second shooter, intern...). This is NOT the same as wages which are paid to employees which are deductible on the "Wages" line of Schedule C. Independent contractors are people you have "the right to control or direct only the result of the work," not when and how will be done (IRS.gov). Insurance. More specifically, business insurance such as general liability insurance or equipment insurance. Legal & Professional Fees. Accountants, tax preparers, lawyers, bookkeepers... Yes, the fees to have someone take care of your bookkeeping is deductible on your taxes! That's a win-win! Supplies. This includes any supplies that are used in your business: pens, printer ink, paper clips... any supply you use and replace in your business. Website designers may also deduct digital supplies such as stock photography or website plugins. Other Expenses. Continuing education, bank or credit card fees, membership dues, client gifts, industry subscriptions, etc. The IRS says anything that is "ordinary and necessary" for running your business is deductible. So, graphic designers, you cannot deduct chocolate while chocolatiers may... Want a handy little reference sheet so you can remember these categories and others? I thought so. Click the photo below and sign up to receive your free cheat sheet.

0 Comments

Did you know that your business needs a budget? Yes, just like you need a budget for your personal finances you need one for your business. Managing money is essential if you want to succeed in your business. Part of being successful at this is having a monthly budget. Yes, I know you're a creative and this is overwhelming. But stay with me. I'll make this quick and painless. The goal of a budget is to make the most of the resources you have in order to reach your business goals (and probably some personal ones too!). A budget is simply telling your money where to go instead of wondering where it went. Here are three steps to start your business budget:

Now set up your budget like this:

Remember when you first start your business you will not be able to create a perfect budget. Budgets develop over time. Make an educated guess at the beginning and adjust it every month until you have something that works for you.

|