BlogBookkeeping tips to help you build a solid financial foundation for your business. |

|

How many entrepreneurs are thinking of tax season now? Very few. But how many should be? Every single one! There are three things you can do today to make tax season a breeze: Save Your Receipts. Whether you save them in a file folder or in the cloud, it's up to you. The important thing is that all your business receipts are saved. Why? Because they are required by the IRS if you are audited. They want to see the receipt from Target showing you actually bought office supplies and not a new wardrobe. The burden to prove all those transactions in your bank account are business related will be on you. Taking the time to file receipts today will save you a lot of stress should you be audited later. Setup a Bookkeeping System. I highly recommend QuickBooks Online. It's a cloud-based accounting program. Before you run away because you're scared of numbers, let me tell you how QuickBooks Online has helped my clients!

Tax Plan. I highly recommend all my clients (and you too!) find a local CPA to work with. A good CPA will offer tax planning services. This is a meeting before the end of the year to help you take tax-saving actions such as identifying deductions, making charitable contributions, or buying new equipment. It is best to schedule this meeting sometime between mid-October through December. How prepared do you feel for tax season?

0 Comments

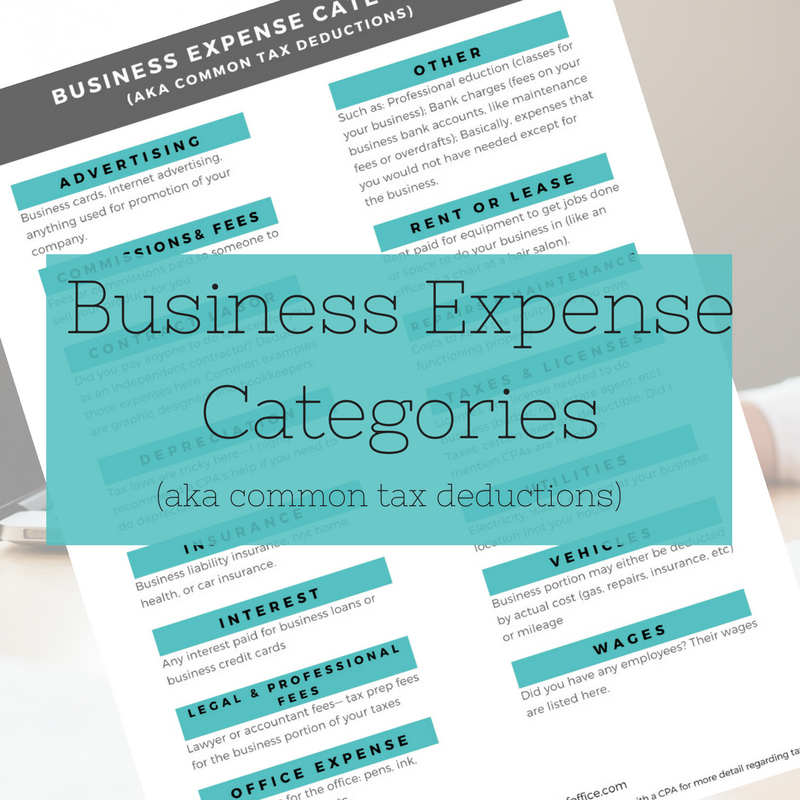

Tracking business expenses is important because they ultimately become tax deductions which means saving money (and who doesn't want to save money!). But where's an entrepreneur to start? Here is a quick overview to get you on the right track.

Advertising. Includes any materials you use for marketing (e.g. bridal guide magazines, Facebook ads, and email services like Flodesk or Mail Chimp. Unbranded gifts, such as books, are not considered advertising (they are considered "other expenses" though!). Contract Labor. Payments you make to independent contractors (e.g. freelancers you hired for additional project support: virtual assistant, second shooter, intern...). This is NOT the same as wages which are paid to employees which are deductible on the "Wages" line of Schedule C. Independent contractors are people you have "the right to control or direct only the result of the work," not when and how will be done (IRS.gov). Insurance. More specifically, business insurance such as general liability insurance or equipment insurance. Legal & Professional Fees. Accountants, tax preparers, lawyers, bookkeepers... Yes, the fees to have someone take care of your bookkeeping is deductible on your taxes! That's a win-win! Supplies. This includes any supplies that are used in your business: pens, printer ink, paper clips... any supply you use and replace in your business. Website designers may also deduct digital supplies such as stock photography or website plugins. Other Expenses. Continuing education, bank or credit card fees, membership dues, client gifts, industry subscriptions, etc. The IRS says anything that is "ordinary and necessary" for running your business is deductible. So, graphic designers, you cannot deduct chocolate while chocolatiers may... Want a handy little reference sheet so you can remember these categories and others? I thought so. Click the photo below and sign up to receive your free cheat sheet. |